Customer Background

The client is a prominent insurance company with a rich history in the industry. Over the years, they have accumulated a vast amount of policy data and built a legacy policy management system to handle their operations globally.

Challenges

The insurance company faced several challenges with their legacy policy management system, which hindered their ability to meet dynamic industry demands. Some of the major obstacles they encountered were:

- Outdated technology: The legacy system was built on outdated technology, making it difficult to integrate with modern tools and services.

- Inflexible architecture: The existing system had a monolithic architecture, limiting the company’s ability to quickly adapt to changing business needs and regulations.

- Data silos: Policy data was scattered across various silos within the organization, resulting in inefficiencies and making it challenging to gain a comprehensive view of customer information.

- Slow processing times: Due to the system inefficiency, policy processing times were slower, leading to customer dissatisfaction and potential business loss.

- Lack of automation: Manual processes were prevalent, leading to increased administrative burdens and human errors.

Solutions

To address the challenges faced by the insurance company, Softweb Solutions proposed a comprehensive modernization plan to transform their policy management system into a robust and agile platform. Here are the key features of the solution:

- Cloud-based Infrastructure: We migrated the policy management system to a cloud-based infrastructure to ensure scalability, flexibility and seamless integration with modern technologies.

- API integration: We used API integration to break down data silos, enabling real-time access to policy information and improving overall operational efficiency.

- Microservices architecture: The legacy monolithic architecture was restructured into microservices, allowing for modular development and easier maintenance.

- Artificial intelligence: Leveraging AI, we introduced automation to various processes, such as claims processing and underwriting, to reduce manual efforts and enhance accuracy.

- Mobile accessibility: We developed a user-friendly mobile app, empowering customers to access and manage their policies conveniently on the go.

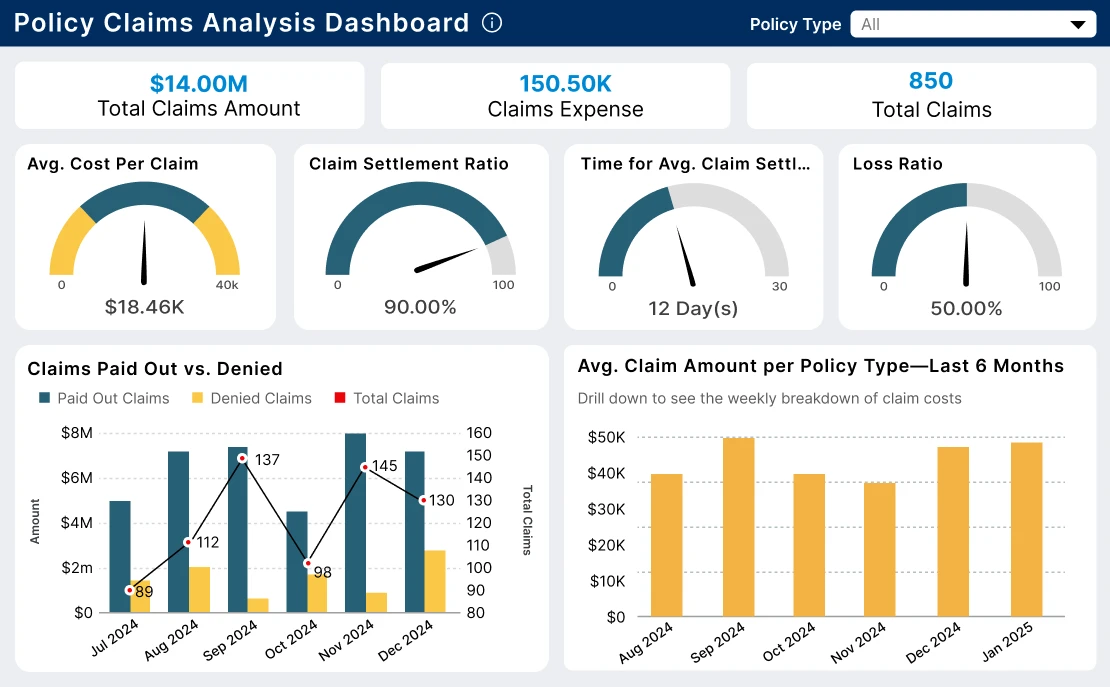

- Data analytics: Utilizing advanced data analytics, we provide actionable insights for better risk assessment, personalized policy offerings and improved customer service.

Dashboard

-

Industry

Insurance

-

Technologies / Platforms / Frameworks

Azure Database Migration Service, Azure Data Factory, Power BI

-

Benefits

- Enhanced customer experience: Faster policy processing and mobile accessibility allow customers to interact seamlessly with the company.

- Improved efficiency: Automation and AI-powered processes streamline operations, reducing processing times and minimizing errors.

- Real-time insights: With data analytics, the company gained valuable insights into customer preferences and risks, enabling more informed decision-making.

- Regulatory compliance: The modernized system ensures compliance with evolving industry regulations, reducing the risk of penalties.

Decade of Trust & Experience

1630+

Projects

545+

Technocrats

26+

Products and Solutions

1020+

Customers

Connect Now

Our experts would be eager to hear you.